Technology

Mengapa Risk Assessment Tradisional Tidak Lagi Efektif di Dunia Bisnis Modern

Traditional assessments are broken. Here's what modern risk management actually looks like

Kezia A.

CEO Of

Diterbitkan :

10 Jul 2025, 00.00

Dalam lanskap B2B Indonesia, pengecekan risiko secara tradisional seperti verifikasi manual NPWP, NIB, dan SIUP tidak lagi mampu mengikuti kebutuhan zaman. Baik Anda adalah brand FMCG yang ingin onboarding distributor, platform procurement yang melakukan screening vendor, atau distributor nasional yang memberikan kredit ke retailer, proses yang lambat dan tidak konsisten dapat menyebabkan keterlambatan, red flag yang terlewat, dan kerugian yang sebenarnya bisa dicegah.

Artikel ini menjelaskan kenapa pendekatan risk assessment tradisional sudah tidak lagi memadai di era yang bergerak cepat, serta bagaimana tools modern seperti RiskWatch membantu tim Indonesia memverifikasi mitra secara instan, mendeteksi fraud sejak awal, dan membuat keputusan lebih cepat dan cerdas dengan data aktual — bukan file usang atau dokumen yang terpisah-pisah.

Kenapa Risk Assessment Tradisional Mulai Gagal

Risk assessment dulunya efektif saat bisnis masih berjalan lambat, rantai pasok sederhana, dan risiko fraud lebih kecil. Tapi kini, perusahaan harus menilai lebih banyak mitra, mengambil keputusan lebih cepat, dan melindungi diri dari risiko yang makin kompleks.

4 alasan utama kenapa metode tradisional tidak lagi efektif:

1. Terlalu Lambat dan Terlalu Manual

Proses tradisional bergantung pada dokumen fisik. Tim menghabiskan waktu berjam-jam untuk mengumpulkan dokumen seperti NIB, NPWP, SIUP, lalu memverifikasi melalui telepon atau menunggu laporan PDF dari lembaga terkait.

Proses seperti ini tidak bisa diskalakan — memperlambat procurement, onboarding, dan persetujuan kredit.

2. Berdasarkan Data yang Sudah Usang

Data risiko biasanya diambil dari database publik lalu disimpan dalam bentuk screenshot atau spreadsheet. Padahal status hukum, kepemilikan, atau kondisi keuangan bisa berubah sewaktu-waktu.

Dokumen statis tidak mencerminkan perubahan ini, sehingga keputusan dibuat berdasarkan informasi yang sudah basi.

Statistik: Berdasarkan data dari PPATK, fraud korporat dan transaksi mencurigakan dalam pengadaan dan kerja sama vendor berkontribusi pada kerugian lebih dari Rp6 triliun antara 2020–2023.

🔹 Sumber: Laporan Tahunan dan Ringkasan Kasus PPATK.

3. Tidak Bisa Deteksi Fraud Secara Nyata

Pendekatan tradisional seringkali gagal mendeteksi red flag seperti:

Perusahaan cangkang atau duplikasi vendor

Direktur yang sama di banyak entitas

Individu atau alamat yang masuk daftar hitam

Kecuali seseorang memang ahli dan punya waktu untuk investigasi, sebagian besar tanda ini terlewatkan.

4. Sulit Diskalakan dan Diaudit

Proses manual berbeda-beda antar tim atau individu. Tidak ada sistem skoring konsisten, tidak ada jejak audit yang jelas, dan minim dokumentasi. Ini menyulitkan untuk justifikasi keputusan, lolos audit, atau membela penolakan kredit.

Apa yang Harus Dimiliki oleh Platform Risk Assessment Modern

Tools risk assessment modern dirancang untuk mengisi celah-celah di atas. Tapi tidak semuanya sama. RiskWatch menonjol karena menggabungkan teknologi real-time dan investigasi berbasis ahli.

Bagaimana pendekatan hybrid ini bekerja secara nyata:

Akses Real-Time ke Data Bisnis Terverifikasi

RiskWatch menarik data dari sumber resmi seperti AHU, OSS, dan biro kredit berlisensi. Tim bisa langsung memverifikasi status hukum, kepemilikan, dan status aktif perusahaan dengan data aktual.

Ini menghilangkan dugaan dan mempercepat proses tanpa mengorbankan akurasi.

Skor Kredit dari Biro Kredit dengan Konteks Jelas

Alih-alih membuat sistem skoring sendiri, RiskWatch menggunakan data pihak ketiga untuk memberi skor risiko berdasarkan perilaku pembayaran, validasi dokumen, dan sinyal bisnis.

Setiap skor disertai penjelasan faktor pendorongnya, agar tim kredit dan komersial bisa memahami dan percaya hasilnya.

Deteksi Fraud Otomatis + Eskalasi ke Analis

Cek otomatis mendeteksi indikator fraud seperti:

Kepemilikan silang antar vendor

Perusahaan yang masuk daftar sanksi

Identitas bisnis duplikat dengan nama berbeda

Jika ada anomali, kasus akan diteruskan ke analis internal RiskWatch — profesional terlatih yang menyelidiki profil risiko tinggi dan menangani kasus khusus yang tidak bisa diselesaikan otomatis.

🔍 Analogi: RiskWatch seperti gerbang e-Toll di jalan tol. Mobil biasa bisa lewat cepat dengan RFID. Tapi kalau ada masalah, seperti saldo kurang atau plat tidak cocok, gerbang tidak akan terbuka — dan pengecekan manual dilakukan. Cepat untuk mayoritas, cerdas untuk kasus khusus.

Laporan Siap Pakai dan Jejak Keputusan yang Jelas

Setiap verifikasi menghasilkan laporan yang bisa diunduh, berisi:

Data hukum dan keuangan terverifikasi

Indikator risiko dan catatan fraud

Catatan analis (jika ada)

Timestamp dan log user

Ini memberi tim procurement, operasional, dan kredit dokumentasi yang dibutuhkan untuk mengambil keputusan — dan mempertahankannya bila diperlukan.

Tanpa Setup Developer atau Integrasi IT

RiskWatch berbasis web sepenuhnya. Tidak perlu instalasi atau setup API. Tim bisa langsung memverifikasi, melihat skor, dan mengunduh laporan sejak hari pertama.

Dirancang untuk kecepatan dan kemudahan.

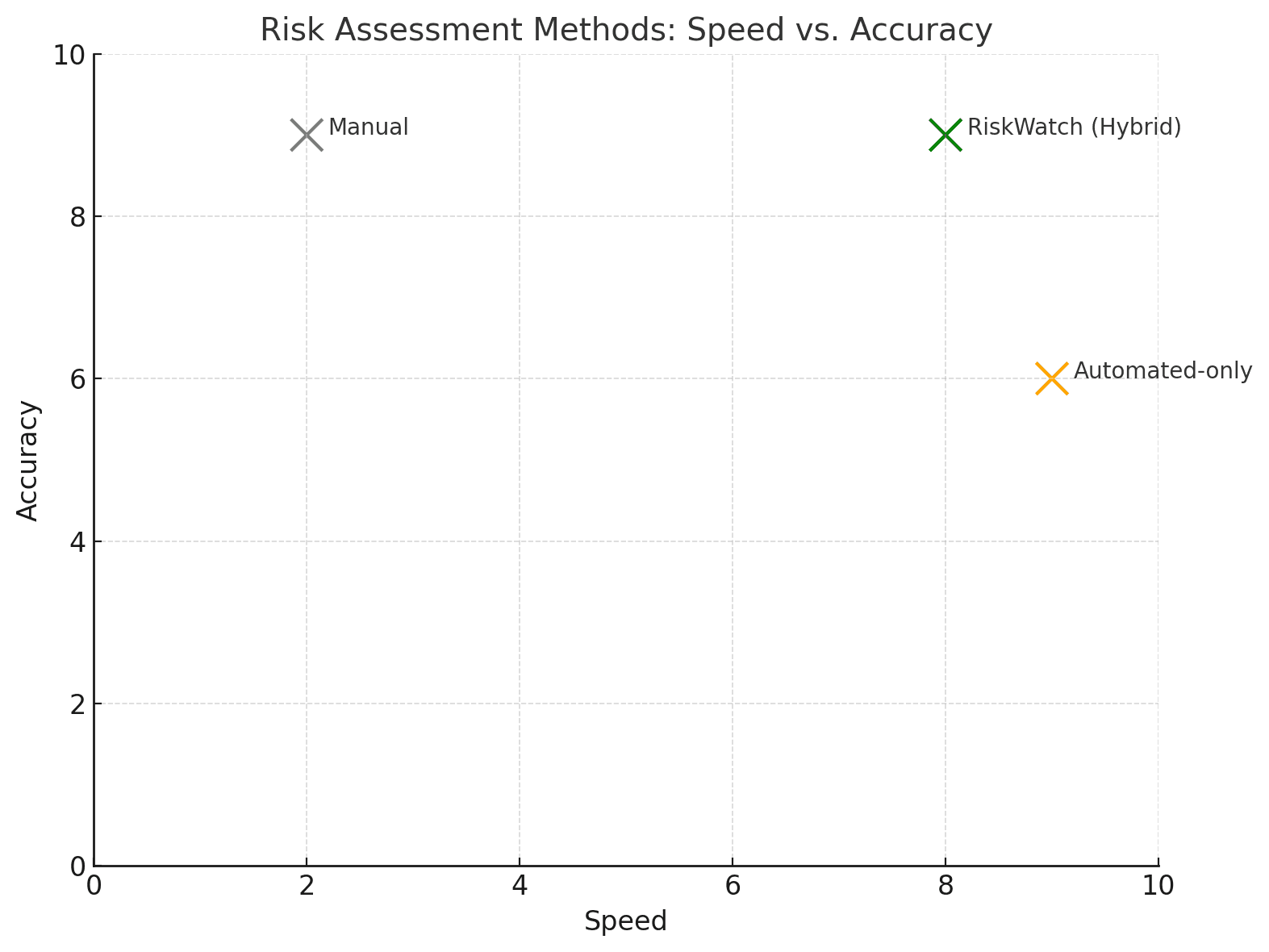

Perbandingan Risk Assessment Tradisional vs RiskWatch

Fitur | Pendekatan Tradisional | RiskWatch (Hybrid) |

|---|---|---|

Akurasi Data | Manual & statis | Real-time dari sumber resmi |

Skor Risiko | Subjektif / tidak konsisten | Data-driven & transparan |

Deteksi Fraud | Terbatas atau tidak ada | Otomatis + tinjauan ahli |

Kecepatan | Mingguan atau bulanan | Dalam hitungan jam |

Auditability | Terbatas / informal | Laporan terstruktur + log lengkap |

Akses Tim | Usaha manual tinggi | Portal mudah digunakan semua tim |

Kenapa Model Hybrid Penting

Tools otomatis memang cepat, tapi sering kehilangan nuansa. Proses manual bisa menangkap detail tersebut, tapi lambat dan tidak konsisten.

RiskWatch menggabungkan kecepatan teknologi dan ketelitian investigator.

Pendekatan ini memberi kejelasan dan keyakinan dalam pengambilan keputusan penting.

Statistik: Studi Katadata Insight Center menunjukkan bahwa UKM dan korporasi yang memakai tools digital untuk risk dan kredit onboarding supplier hingga 35% lebih cepat, serta 25% lebih sedikit kasus utang macet, terutama di skema kredit B2B.

FAQ Tentang RiskWatch

Q1: Apakah RiskWatch sepenuhnya otomatis?

Tidak sepenuhnya. RiskWatch mengotomatisasi pengecekan data, profil mitra, dan skoring berbasis logika AI. Namun, kasus yang terindikasi risiko tinggi tetap ditinjau oleh manusia.

Q2: Dari mana asal skor risiko?

Skor dihitung dari kombinasi:

Data eksternal terpercaya

Aturan internal (kelengkapan dokumen, validasi NPWP, histori tunggakan)

Data publik & perilaku perusahaan

Logika risiko yang disesuaikan dengan konteks bisnis Anda

Q3: Apa yang terjadi jika vendor terdeteksi berisiko tinggi?

Tim Anda akan mendapat notifikasi di dashboard RiskWatch. Anda bisa meninjau detail skor dan menentukan langkah selanjutnya seperti monitoring, eskalasi, atau pelaporan internal.

Jika memakai fitur Auto Collections, sistem juga bisa mengirim pengingat atau surat resmi sesuai pengaturan Anda.

Q4: Apakah perlu tim teknis untuk menggunakannya?

Tidak. RiskWatch adalah platform plug-and-play untuk tim komersial, keuangan, dan procurement. Anda bisa unggah data mitra, pantau skor, dan ambil tindakan langsung dari dashboard tanpa setup teknis.

Tersedia juga AI Assistant terintegrasi untuk bantu navigasi dan keputusan.

Penutup: Risk Assessment yang Lebih Cerdas, Keputusan yang Lebih Aman

Risk assessment tetap penting tapi cara melakukannya perlu berubah.

Pendekatan manual terlalu lambat dan rawan kesalahan. Tools otomatis sering kehilangan konteks.

RiskWatch menawarkan pendekatan cerdas: menggabungkan data real-time dan tinjauan ahli.

Baik saat Anda ingin verifikasi vendor, memberikan kredit, atau scaling partnership, RiskWatch membantu tim Indonesia bergerak cepat, mendeteksi risiko lebih awal, dan membuat keputusan lebih baik tanpa mengorbankan akal sehat manusia.

Streamline onboarding dan kurangi risiko vendor dengan RiskWatch. Verifikasi mitra Indonesia dalam hitungan jam, bukan minggu.